Calculate pa sales tax

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Pennsylvania local counties cities and special taxation. Ad Standardize Taxability on Sales and Purchase Transactions.

Pennsylvania Sales Tax Guide For Businesses

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Pennsylvania local counties cities and special taxation.

. The Pennsylvania PA state sales tax rate is currently 6. Choose city or other locality from Pennsylvania below for local Sales Tax calculation. Pennsylvania Sales Tax Calculator You can use our Pennsylvania Sales Tax Calculator to look up sales tax rates in Pennsylvania by address zip code.

Pennsylvania Income Tax Calculator 2021. The Pennsylvania sales tax rate is 6 percent. The price of the coffee maker is 70 and your state sales tax is 65.

Depending on local municipalities the total tax rate can be as high as 8. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

All numbers are rounded in. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Calculating how much sales tax you should remit to the state of Pennsylvania is easy with TaxJars Pennsylvania sales tax report.

Pa Sales Tax Calculate information registration support. Tax info is updated from. You can see the total tax percentages of localities in the buttons.

Before-tax price sale tax rate and final or after-tax price. 65 100 0065. 6 percent state tax plus an additional 1 percent local tax for items purchased in delivered to or used in Allegheny County and 2 percent local.

Get the benefit of tax research and calculation experts with Avalara AvaTax software. Sales Tax calculator Philadelphia Fill in price either with or without sales tax. Your average tax rate is 1198 and your.

Pennsylvania is one of the few states with a single. All you do is connect the channels through which you. Your household income location filing status and number of personal.

Then deduct the value of. Step Two - Calculate Penalty and Interest Penalty is calculated by multiplying the total tax due by 5 percent for each month or portion of a month the tax remains unpaid. Divide tax percentage by 100.

List price is 90 and tax percentage is 65. The results are rounded to two decimals. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Use this simple formula to calculate how much you need to expect to pay in state sales tax on your car. First take the purchase price for your vehicle. The use tax rate is the same as the sales tax rate.

Automate Standardize Taxability on Sales and Purchase Transactions. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 612 in Pennsylvania. Multiply price by decimal.

Sales Tax Table For Pennsylvania. Businesses required to make prepayments for sales use and hotel occupancy tax by the 20th of each month and having an actual tax liability for the third quarter of the previous year of at. Ad New State Sales Tax Registration.

The calculator will show you the total. Use the sales tax formula below or the handy. If you make 70000 a year living in the region of Pennsylvania USA you will be taxed 10536.

Once youve found the correct sales tax rate for your area you need to figure out how much to charge each customer on their purchases.

Pennsylvania Sales Tax Small Business Guide Truic

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Sales Tax Calculator Taxjar

Pennsylvania Sales Tax Guide For Businesses

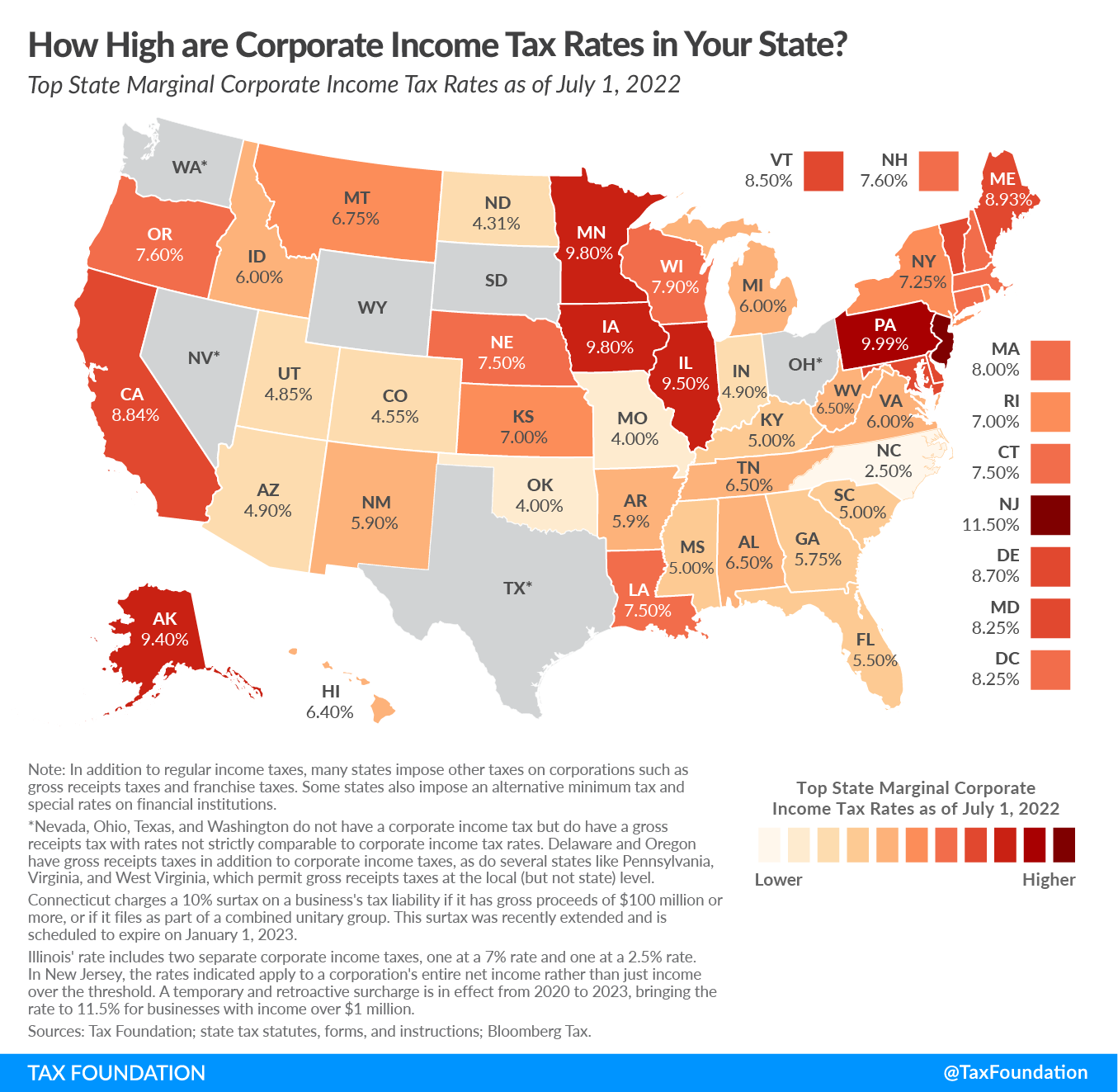

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

What Is Sales Tax A Complete Guide Taxjar

Pennsylvania Sales Tax Guide For Businesses

How To Calculate Sales Tax For Your Online Store

Pa Corporate Tax Cut Details Analysis Tax Foundation

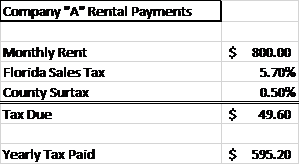

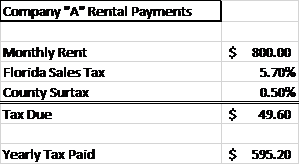

How To Calculate Fl Sales Tax On Rent

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Pennsylvania Vehicle Sales Tax Fees Calculator Find The Best Car Price

Pennsylvania Sales Tax Guide For Businesses

Pennsylvania Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax On Grocery Items Taxjar

Sales Tax Calculator Taxjar